Financial markets have been thrown a fresh curve ball by the decision to write down 16 billion Swiss francs ($17.5 billion) of Credit Suisse bonds, known as Additional Tier 1 or AT1 debt, to zero as part of a forced rescue merger with UBS .

AT1 bonds - a $275 billion sector also known as "contingent convertibles" or "CoCo" bonds - act as shock absorbers if a bank's capital levels fall below a certain threshold. They can be converted into equity or written off.

They make up part of the capital cushion that regulators require banks to hold to provide support in times of market turmoil.If AT1s are converted into equity, this supports a bank's balance sheet and helps it to stay afloat. They also pave the way for a "bail-in", or a way for banks to transfer risks to investors and away from taxpayers if they get into trouble.AT1s rank higher than shares in the capital structure of a bank.

In Switzerland, the bonds' terms state, however, that in a restructuring, the financial watchdog is under no obligation to adhere to the traditional capital structure, which is how bondholders lost out in the Credit Suisse situation. Credit Suisse AT1 holders, therefore, are the only ones not to receive any kind of compensation. Under the rescue deal, they rank lower than shareholders in the bank, who can at least get UBS' takeover price of 0.76 Swiss francs per share.

Argentina Últimas Noticias, Argentina Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

Explainer: Credit Suisse bondholders seek legal advice on AT1 wipe-outCredit Suisse bondholders are seeking legal advice after the Swiss regulator ordered 16 billion Swiss francs ($17.5 billion) of Additional Tier-1 (AT1) debt to be wiped out under its rescue takeover by UBS .

Explainer: Credit Suisse bondholders seek legal advice on AT1 wipe-outCredit Suisse bondholders are seeking legal advice after the Swiss regulator ordered 16 billion Swiss francs ($17.5 billion) of Additional Tier-1 (AT1) debt to be wiped out under its rescue takeover by UBS .

Leer más »

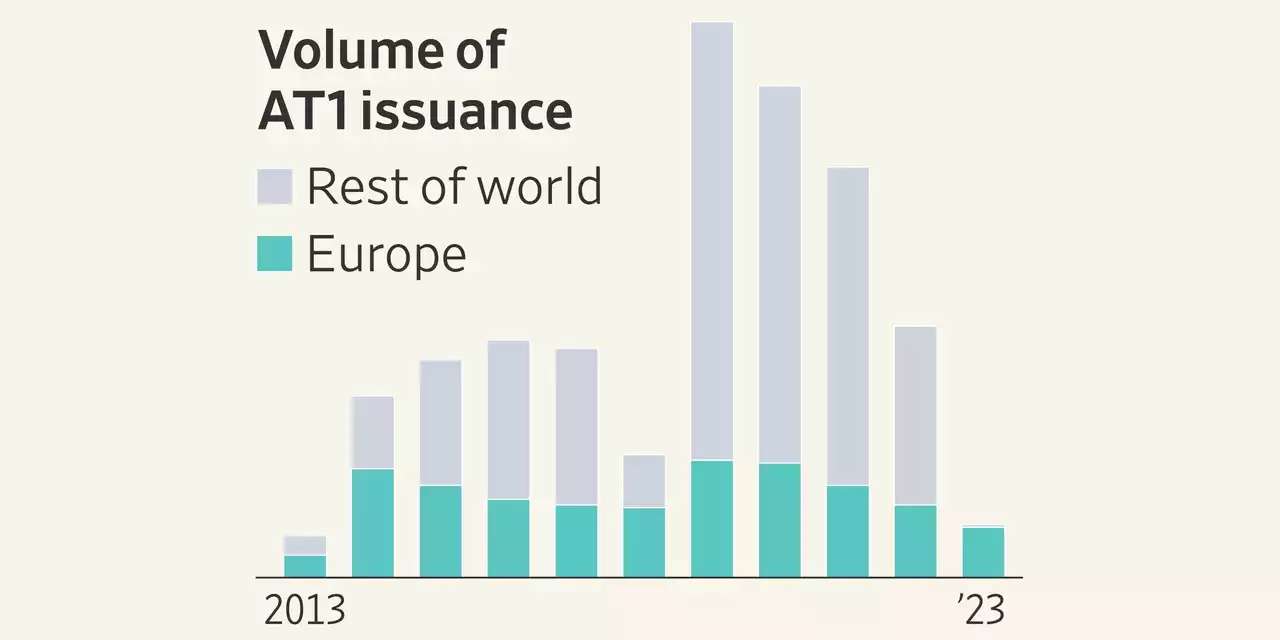

What Are AT1 Bonds, and Why Are They Risky?Investors lost more than $17 billion in bank debt during the Credit Suisse takeover. The Swiss bank is just one institution with which AT1 bonds have been popular in recent years.

What Are AT1 Bonds, and Why Are They Risky?Investors lost more than $17 billion in bank debt during the Credit Suisse takeover. The Swiss bank is just one institution with which AT1 bonds have been popular in recent years.

Leer más »

Swiss regulator says central bank loan to Credit Suisse justified AT1 bond writedown

Swiss regulator says central bank loan to Credit Suisse justified AT1 bond writedown

Leer más »

Swiss regulator defends its decision to write off AT1 bondsSwitzerland's financial market regulator FINMA defended its decision to impose steep losses on Credit Suisse bond holders on Thursday, saying the decision was legally watertight.

Swiss regulator defends its decision to write off AT1 bondsSwitzerland's financial market regulator FINMA defended its decision to impose steep losses on Credit Suisse bond holders on Thursday, saying the decision was legally watertight.

Leer más »

StanChart CEO says AT1 bond wipeout has profound impactStandard Chartered Chief Executive Bill Winters said on Friday Credit Suisse AG's $17 billion Additional Tier 1 bonds wipeout had 'profound' implications for global bank regulations.

StanChart CEO says AT1 bond wipeout has profound impactStandard Chartered Chief Executive Bill Winters said on Friday Credit Suisse AG's $17 billion Additional Tier 1 bonds wipeout had 'profound' implications for global bank regulations.

Leer más »

European banks default-risk indicator jumps, AT1 bonds fallThe cost of insuring against the likelihood of default by European banks rose sharply on Friday, as concern about the outlook for the sector continued to grip markets, almost a week on from the collapse of Credit Suisse .

European banks default-risk indicator jumps, AT1 bonds fallThe cost of insuring against the likelihood of default by European banks rose sharply on Friday, as concern about the outlook for the sector continued to grip markets, almost a week on from the collapse of Credit Suisse .

Leer más »