While AT1s pay high interest to bondholders, their mechanics can make them a risky investment. What are additional Tier 1 bonds, and why are they risky?

Swiss regulators announced on March 19 a wipeout of more than $17 billion of Credit Suisse Group AG’s

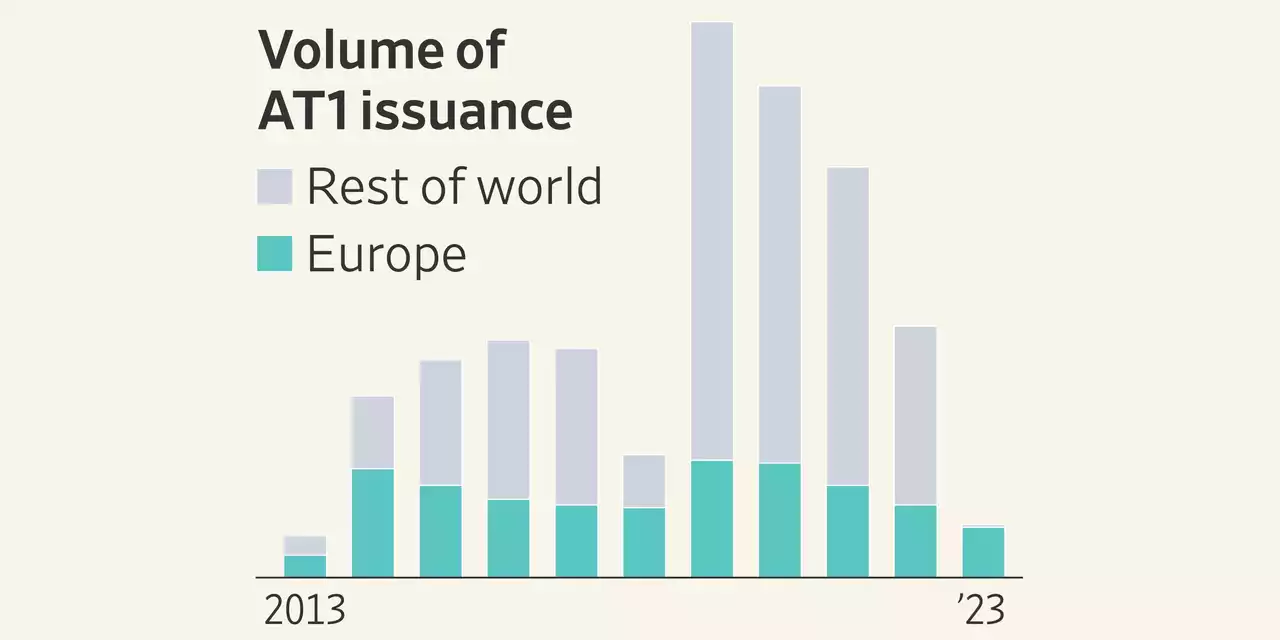

, or AT1s, shocking investors as shareholders were paid out before some bondholders. AT1 bonds deliver higher yields than many comparable assets, which makes them attractive to investors willing to take the risk.. Following the 2008 financial crisis, many countries in Europe signed on to a regulatory framework called Basel III, under which they passed laws requiring large banks to maintain a financial cushion for protection during a downturn.

Argentina Últimas Noticias, Argentina Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

Swiss regulator defends its decision to write off AT1 bondsSwitzerland's financial market regulator FINMA defended its decision to impose steep losses on Credit Suisse bond holders on Thursday, saying the decision was legally watertight.

Swiss regulator defends its decision to write off AT1 bondsSwitzerland's financial market regulator FINMA defended its decision to impose steep losses on Credit Suisse bond holders on Thursday, saying the decision was legally watertight.

Leer más »

European banks default-risk indicator jumps, AT1 bonds fallThe cost of insuring against the likelihood of default by European banks rose sharply on Friday, as concern about the outlook for the sector continued to grip markets, almost a week on from the collapse of Credit Suisse .

European banks default-risk indicator jumps, AT1 bonds fallThe cost of insuring against the likelihood of default by European banks rose sharply on Friday, as concern about the outlook for the sector continued to grip markets, almost a week on from the collapse of Credit Suisse .

Leer más »

Swiss regulator says central bank loan to Credit Suisse justified AT1 bond writedown

Swiss regulator says central bank loan to Credit Suisse justified AT1 bond writedown

Leer más »

Explainer: Credit Suisse bondholders seek legal advice on AT1 wipe-outCredit Suisse bondholders are seeking legal advice after the Swiss regulator ordered 16 billion Swiss francs ($17.5 billion) of Additional Tier-1 (AT1) debt to be wiped out under its rescue takeover by UBS .

Explainer: Credit Suisse bondholders seek legal advice on AT1 wipe-outCredit Suisse bondholders are seeking legal advice after the Swiss regulator ordered 16 billion Swiss francs ($17.5 billion) of Additional Tier-1 (AT1) debt to be wiped out under its rescue takeover by UBS .

Leer más »

StanChart CEO says AT1 bond wipeout has profound impactStandard Chartered Chief Executive Bill Winters said on Friday Credit Suisse AG's $17 billion Additional Tier 1 bonds wipeout had 'profound' implications for global bank regulations.

StanChart CEO says AT1 bond wipeout has profound impactStandard Chartered Chief Executive Bill Winters said on Friday Credit Suisse AG's $17 billion Additional Tier 1 bonds wipeout had 'profound' implications for global bank regulations.

Leer más »

UBS buys back bonds days after issue to buoy investor confidenceUBS Group said on Wednesday it would buy back 2.75 billion euros ($2.96 billion) worth of debt it sold just days ago in a bid to boost confidence among bondholders rattled by its $3 billion rescue of rival Credit Suisse.

UBS buys back bonds days after issue to buoy investor confidenceUBS Group said on Wednesday it would buy back 2.75 billion euros ($2.96 billion) worth of debt it sold just days ago in a bid to boost confidence among bondholders rattled by its $3 billion rescue of rival Credit Suisse.

Leer más »