The yen was pinned to a six-year low on the dollar and struggled against crosses on Thursday, as a rate hike with a hawkish outlook from the U.S. Federal Reserve underscored just how far the Bank of Japan is likely to lag worldwide policy tightening.

The Fed has raised interest rates for the first time since 2018 and policymakers' projections for as many as six more hikes this year were even more aggressive than expected.

"The market is expecting the Fed to ramp interest rates higher during the course of this year. By contrast the BoJ is committed to extremely accommodation policy settings," said Jane Foley, senior FX strategist at Rabobank in London. The gap between benchmark 10-year Treasury yields and 10-year Japanese bond yields hit its widest in nearly 2-1/2 years overnight at 1.99%.

The Australian dollar jumped through its 200-day moving average to $0.7308 after better-than-expected employment data, while the kiwi was weighed a little bit and was flat at $0.6836 after softer-than-expected growth data.read more

Argentina Últimas Noticias, Argentina Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

USD/JPY Technical Outlook: US Fed and BoJ Central Bank PreviewTomorrow marks a rather significant day in financial markets as the Federal Reserve Bank is scheduled to announce its first rate hike since the pandemic. Get your market update from RichardSnowFX here:

USD/JPY Technical Outlook: US Fed and BoJ Central Bank PreviewTomorrow marks a rather significant day in financial markets as the Federal Reserve Bank is scheduled to announce its first rate hike since the pandemic. Get your market update from RichardSnowFX here:

Leer más »

Producer Price Index hits 10% increase as Fed eyes rate hikePrices paid to U.S. producers rose at an annual rate of 10% in February on higher costs of goods, further highlighting record-setting inflation as the Federal Reserve prepares to raise a key interest rate this week.

Producer Price Index hits 10% increase as Fed eyes rate hikePrices paid to U.S. producers rose at an annual rate of 10% in February on higher costs of goods, further highlighting record-setting inflation as the Federal Reserve prepares to raise a key interest rate this week.

Leer más »

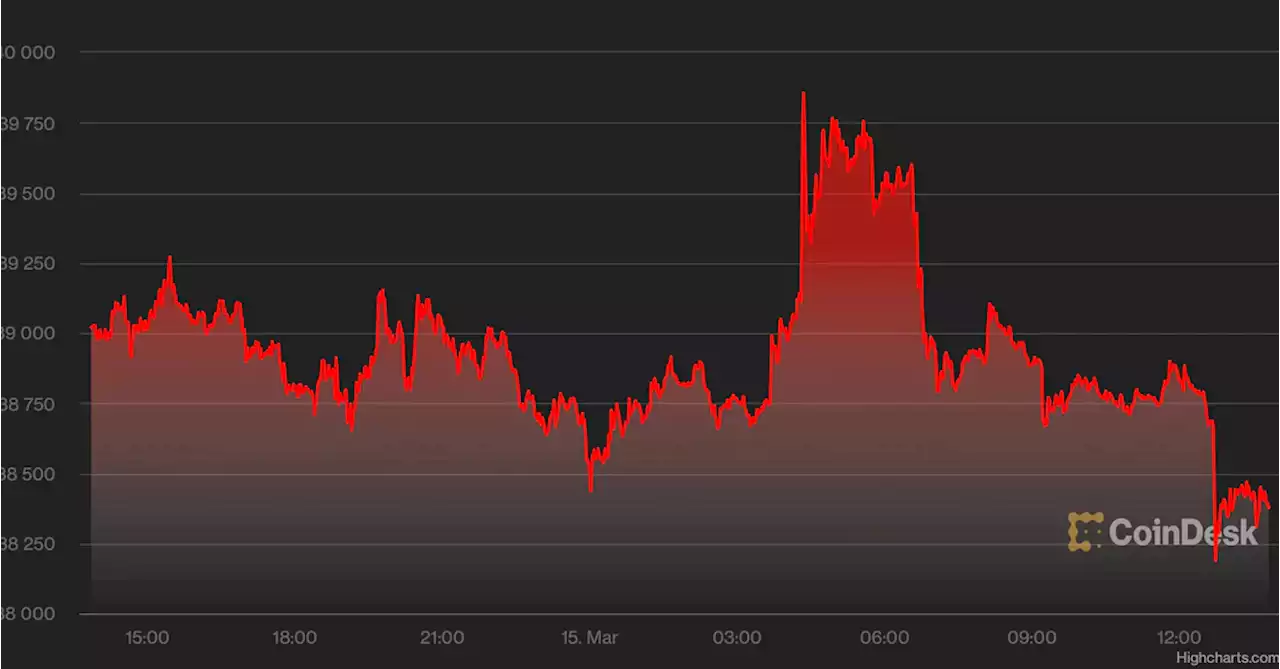

Bitcoin fails to crack $39K on Wall Street open as markets await Fed inflation decisionWhat will happen to Bitcoin when the Fed speaks? Nerves kick in on BTC markets.

Bitcoin fails to crack $39K on Wall Street open as markets await Fed inflation decisionWhat will happen to Bitcoin when the Fed speaks? Nerves kick in on BTC markets.

Leer más »

Raskin nomination for Fed endangered by Manchin's oppositionManchin's opposition could doom her confirmation prospects if Raskin can't pick up a Republican vote in the Senate.

Raskin nomination for Fed endangered by Manchin's oppositionManchin's opposition could doom her confirmation prospects if Raskin can't pick up a Republican vote in the Senate.

Leer más »

Bitcoin Breakout Elusive as Traders Price in 7 Fed Rate Hikes For 2022Bitcoin narrowly misses a breakout above $40,000 as traders ramp up Fed rate hike bets. reports godbole17

Bitcoin Breakout Elusive as Traders Price in 7 Fed Rate Hikes For 2022Bitcoin narrowly misses a breakout above $40,000 as traders ramp up Fed rate hike bets. reports godbole17

Leer más »

White House 'made aware' of Manchin's Fed nominee opposition ahead of timeThe White House wasn't caught off guard when West Virginia Sen. Joe Manchin announced his opposition to Sarah Bloom Raskin for a top Federal Reserve role, likely killing her nomination.

White House 'made aware' of Manchin's Fed nominee opposition ahead of timeThe White House wasn't caught off guard when West Virginia Sen. Joe Manchin announced his opposition to Sarah Bloom Raskin for a top Federal Reserve role, likely killing her nomination.

Leer más »