In mid-March, as prices for U.S. Treasury bonds swung wildly following the collapse of Silicon Valley Bank, the trading desk at Legal & General Investment Management hit its top limits for both profit and loss several times in a single day.

"We'd be swinging from our profit-taking target to our loss tolerance level and back again, a couple of times within a 24-hour period," said Chris Jeffery, head of rates and inflation strategy at LGIM, Britain's largest asset manager.

Bonds can be volatile, acknowledged LGIM's Jeffery, citing sharp, fast moves in Italian, UK and emerging market debt within the last decade. The woes in the banking sector, including Credit Suisse's takeover by rival UBS, have further clouded the rates outlook, leaving government bonds vulnerable to further price swings.Shares in troubled U.S.

Citi's head of euro linear rates trading Zoeb Sachee said bond traders were at a "crossroads", unsure whether central banks would deliver more rate hikes to curb inflation or hold off to avoid creating financial stress. This meant he was reducing the risk he was taking on a daily basis, Madziyire said, adding he found it harder to trade $100 million of 10-year bonds "because no one wants to be locked into a $100 million position".

Traders said they were not concerned about the long-term functioning of the bond markets, but warned they remain vulnerable to further bouts of extreme volatility, especially while the policy outlook is uncertain.

Argentina Últimas Noticias, Argentina Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

![]() Silicon Valley company raises $250M for hydrogen technologyIn what could prove a milestone for an industry that hopes to address climate change, the Silicon Valley company Ohmium announced Wednesday it has raised $250 million to expand production of machines that can make clean hydrogen.

Silicon Valley company raises $250M for hydrogen technologyIn what could prove a milestone for an industry that hopes to address climate change, the Silicon Valley company Ohmium announced Wednesday it has raised $250 million to expand production of machines that can make clean hydrogen.

Leer más »

![]() Silicon Valley company raises $250M for hydrogen technologyIn what could prove a milestone for an industry that hopes to address climate change, the Silicon Valley company Ohmium announced Wednesday it has raised $250 million to expand production of machines that can make clean hydrogen.

Silicon Valley company raises $250M for hydrogen technologyIn what could prove a milestone for an industry that hopes to address climate change, the Silicon Valley company Ohmium announced Wednesday it has raised $250 million to expand production of machines that can make clean hydrogen.

Leer más »

![]() Silicon Valley high schooler nearly moves debate judge to tearsNewsweek Mightier supports the next generation of American leaders as they try to find common ground in our fractious, sometimes toxic, national conversation. Read about one SVUDL high schooler whose passion for debate made a judge emotional:

Silicon Valley high schooler nearly moves debate judge to tearsNewsweek Mightier supports the next generation of American leaders as they try to find common ground in our fractious, sometimes toxic, national conversation. Read about one SVUDL high schooler whose passion for debate made a judge emotional:

Leer más »

![]() Silicon Valley-based tech accelerator expands its digital asset vertical to FrancePlug and Play Tech Center is expanding the scope of its crypto and digital asset vertical to its French office.

Silicon Valley-based tech accelerator expands its digital asset vertical to FrancePlug and Play Tech Center is expanding the scope of its crypto and digital asset vertical to its French office.

Leer más »

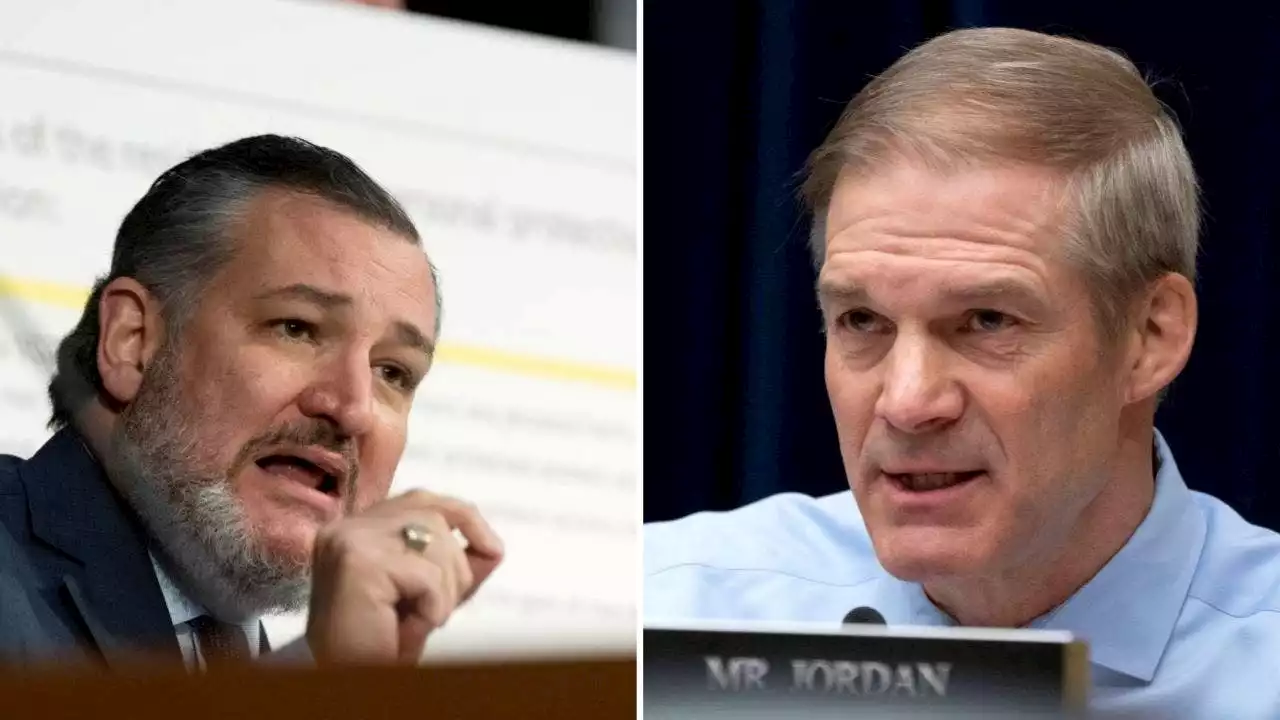

Ted Cruz, Jim Jordan press San Francisco Fed on Silicon Valley Bank collapseSen. Ted Cruz and Rep. Jim Jordan wrote to San Francisco Federal Reserve Chair Mary Daly to request information on the Fed's supervision of Silicon Valley Bank prior to its failure.

Ted Cruz, Jim Jordan press San Francisco Fed on Silicon Valley Bank collapseSen. Ted Cruz and Rep. Jim Jordan wrote to San Francisco Federal Reserve Chair Mary Daly to request information on the Fed's supervision of Silicon Valley Bank prior to its failure.

Leer más »

![]() Former Silicon Valley startup CEO pleads guilty to federal fraud chargesProsecutors said the former CEO of Headspin, a business-software provider, had repeatedly given investors false and exaggerated information in order to gain their financial support.

Former Silicon Valley startup CEO pleads guilty to federal fraud chargesProsecutors said the former CEO of Headspin, a business-software provider, had repeatedly given investors false and exaggerated information in order to gain their financial support.

Leer más »