USD/CAD: A solid rejection of important technical resistance warrants attention – Scotiabank USDCAD Technical Analysis BOC Banks

Spot is grinding a little higher on the day but CAD losses are likely to remain limited ahead of Wednesday’s BoC policy decision.

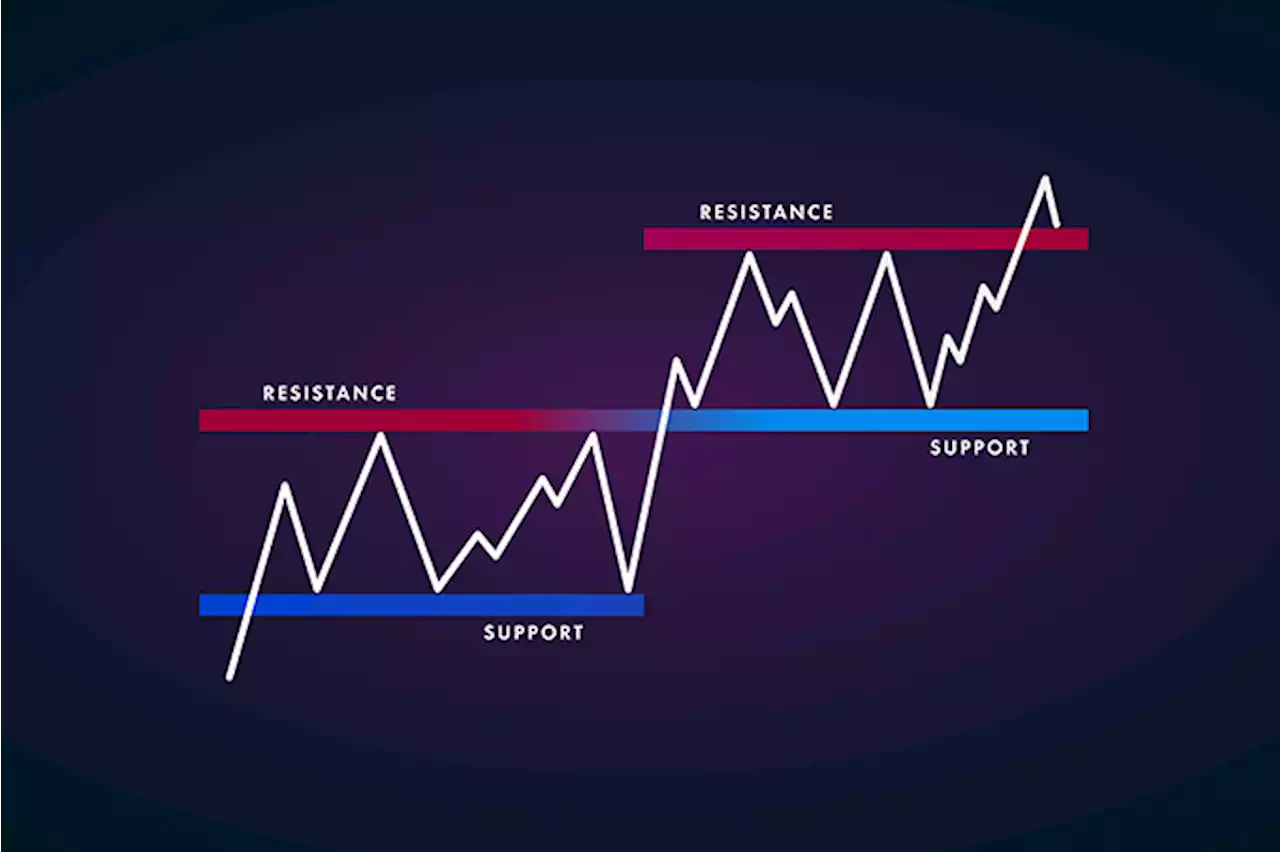

Friday’s session formed a bearish outside range/reversal day, with the peak in the USD developing around important resistance . A solid rejection of important technical resistance warrants attention. Intraday resistance is 1.3325. Key USD support is 1.3275.Information on these pages contains forward-looking statements that involve risks and uncertainties.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Argentina Últimas Noticias, Argentina Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

USD/CAD: Maintain a long position, targeting 1.3700 – NomuraAnalysts at Nomura recommend a long position on the USD/CAD, with a target of 1.3700, enlisting factors that could weigh on the Canadian Dollar (CAD).

USD/CAD: Maintain a long position, targeting 1.3700 – NomuraAnalysts at Nomura recommend a long position on the USD/CAD, with a target of 1.3700, enlisting factors that could weigh on the Canadian Dollar (CAD).

Leer más »

USD/CAD sticks to modest intraday gains, lacks follow-through and remains below 1.3300USD/CAD sticks to modest intraday gains, lacks follow-through and remains below 1.3300 – by hareshmenghani USDCAD Bonds Fed Inflation Currencies

USD/CAD sticks to modest intraday gains, lacks follow-through and remains below 1.3300USD/CAD sticks to modest intraday gains, lacks follow-through and remains below 1.3300 – by hareshmenghani USDCAD Bonds Fed Inflation Currencies

Leer más »

Trading Support and Resistance \u2013 AUD/USD, USD/CADLast week was dominated by relative strength in the Japanese Yen, and relative weakness in the US Dollar. Find out which currency pairs are going to be worth watching this week here:

Trading Support and Resistance \u2013 AUD/USD, USD/CADLast week was dominated by relative strength in the Japanese Yen, and relative weakness in the US Dollar. Find out which currency pairs are going to be worth watching this week here:

Leer más »

USD/CAD falls back from 1.3300 as BoC sets to tighten policy furtherThe USD/CAD pair has attracted offers after a brisk pullback move to near the round-level resistance of 1.3300 in the European session. The Loonie ass

USD/CAD falls back from 1.3300 as BoC sets to tighten policy furtherThe USD/CAD pair has attracted offers after a brisk pullback move to near the round-level resistance of 1.3300 in the European session. The Loonie ass

Leer más »

GBP/US: Key support at 1.2590 needs to hold to avoid a major top – ScotiabankGBP/USD is struggling a little after another failure at 1.2850 late last week. Economists at Scotiabank analyze the pair’s technical outlook. A major

GBP/US: Key support at 1.2590 needs to hold to avoid a major top – ScotiabankGBP/USD is struggling a little after another failure at 1.2850 late last week. Economists at Scotiabank analyze the pair’s technical outlook. A major

Leer más »

Cracks Emerge in Japanese Yen’s Downtrend; USD/JPY, CAD/JPY, MXN/JPY Price SetupsThe Japanese yen looks set this week to shed some of its gains against some of its peers, but cracks are starting to emerge in the Japanese currency’s broader downtrend that could limit any weakness. Read JaradiManish 's analysis here 👇

Cracks Emerge in Japanese Yen’s Downtrend; USD/JPY, CAD/JPY, MXN/JPY Price SetupsThe Japanese yen looks set this week to shed some of its gains against some of its peers, but cracks are starting to emerge in the Japanese currency’s broader downtrend that could limit any weakness. Read JaradiManish 's analysis here 👇

Leer más »