Merck & Co Inc said on Monday it will acquire cancer drug developer Imago BioSciences Inc for a total equity value of $1.35 billion to expand its portfolio of blood disorder treatments.

Estimated revenue potential of the Imago deal is probably not enough to fill the loss of exclusivity gap left by Keytruda later in this decade, BMO Capital Markets analyst Evan Seigerman said.

Seigerman added that he expects the company to do more deals that can help fill the revenue gap from Keytruda's patent loss. Imago, which develops drugs for the treatment of bone marrow-related diseases, is currently testing its lead drug bomedemstat in mid-stage studies for treating certain types of rare blood cancers.

Merck did not provide details on the effect of the Imago deal on its financial results in the near term. The company said it will initiate a tender offer to acquire all outstanding Imago shares through a unit, which will be merged into Imago upon completion of the offer.Reporting by Raghav Mahobe in Bengaluru; Editing by Vinay Dwivedi and Shounak Dasgupta

Argentina Últimas Noticias, Argentina Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

Imago BioSciences stock soars after Merck bids more than 100% premium to buy the biotechShares of Imago BioSciences Inc. undefined soared toward an eight-month high in premarket trading Monday, after the biopharmaceutical company developing...

Imago BioSciences stock soars after Merck bids more than 100% premium to buy the biotechShares of Imago BioSciences Inc. undefined soared toward an eight-month high in premarket trading Monday, after the biopharmaceutical company developing...

Leer más »

Merck Strikes $1.35 Billion Deal for Bone-Marrow Disease Drug DeveloperMerck & Co. said it will pay $36 a share cash for Imago BioSciences, which is developing drugs to treat bone-marrow diseases.

Merck Strikes $1.35 Billion Deal for Bone-Marrow Disease Drug DeveloperMerck & Co. said it will pay $36 a share cash for Imago BioSciences, which is developing drugs to treat bone-marrow diseases.

Leer más »

Week Ahead: Investors Eyeing Battered Consumer Sector | Investing.comMarket Overview Analysis by Pinchas Cohen/Investing.com covering: S&P 500, Dell Technologies Inc, Best Buy Co Inc, Dollar Tree Inc. Read Pinchas Cohen/Investing.com's latest article on Investing.com

Week Ahead: Investors Eyeing Battered Consumer Sector | Investing.comMarket Overview Analysis by Pinchas Cohen/Investing.com covering: S&P 500, Dell Technologies Inc, Best Buy Co Inc, Dollar Tree Inc. Read Pinchas Cohen/Investing.com's latest article on Investing.com

Leer más »

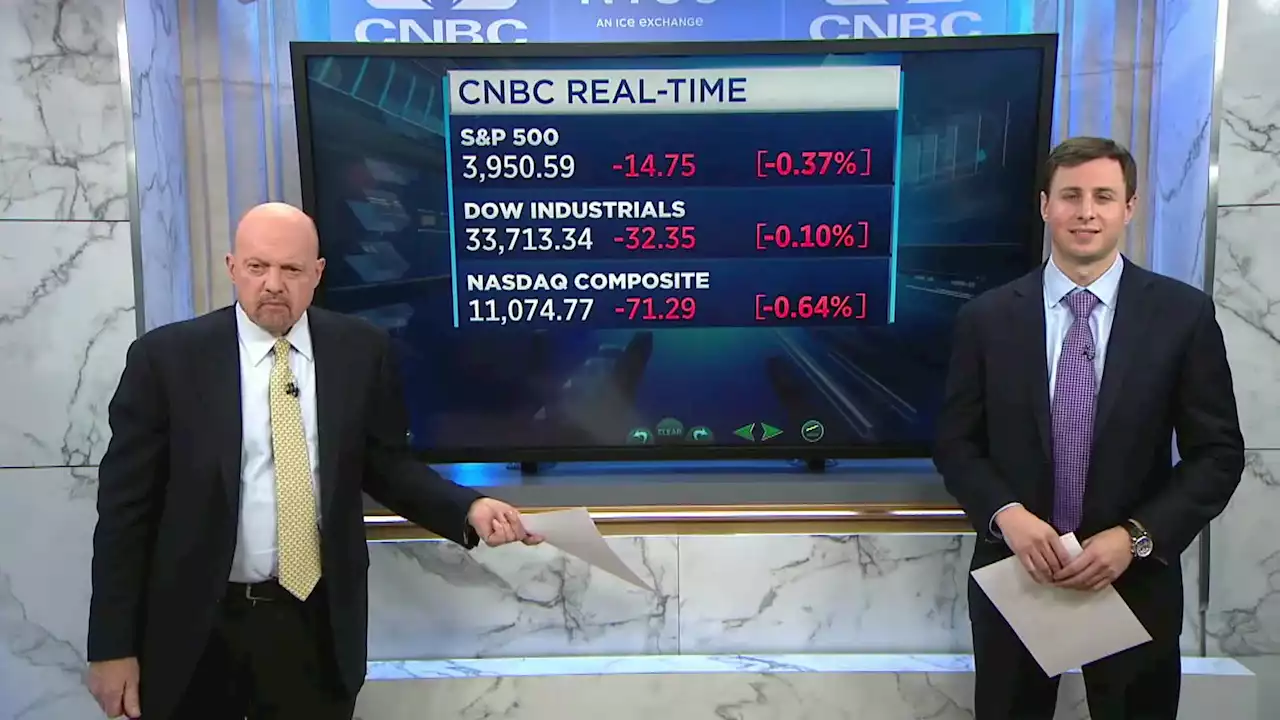

Monday, Nov. 21, 2022: Cramer says you'll want to own these stocks by next yearJim Cramer and Jeff Marks share their thoughts on how deflation is affecting the market, and the Federal Reserve's reaction. Jim breaks down his bullish outlook on Disney now that former CEO Bob Iger is back running the company. Jim also shares a few names Investing Club members will want to own come 2023, and urges them not to get involved with crypto in wake of the FTX controversy.

Monday, Nov. 21, 2022: Cramer says you'll want to own these stocks by next yearJim Cramer and Jeff Marks share their thoughts on how deflation is affecting the market, and the Federal Reserve's reaction. Jim breaks down his bullish outlook on Disney now that former CEO Bob Iger is back running the company. Jim also shares a few names Investing Club members will want to own come 2023, and urges them not to get involved with crypto in wake of the FTX controversy.

Leer más »