Icahn Enterprises extended its prior-day losses on Wednesday after a short seller's report took aim at the company.

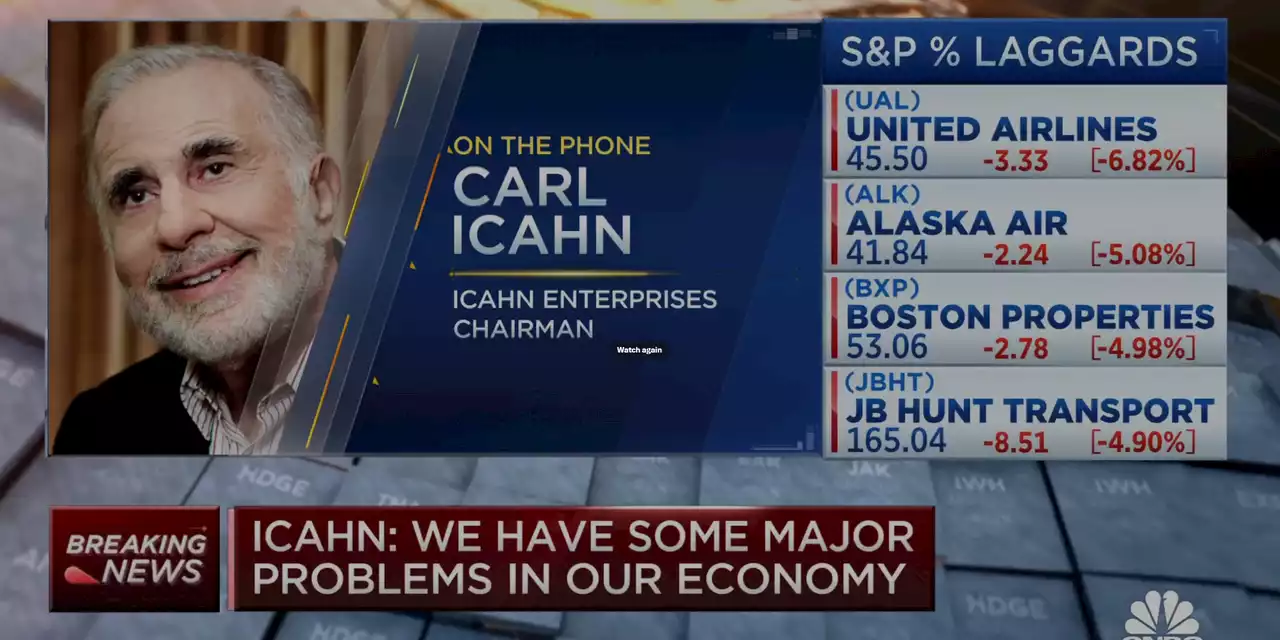

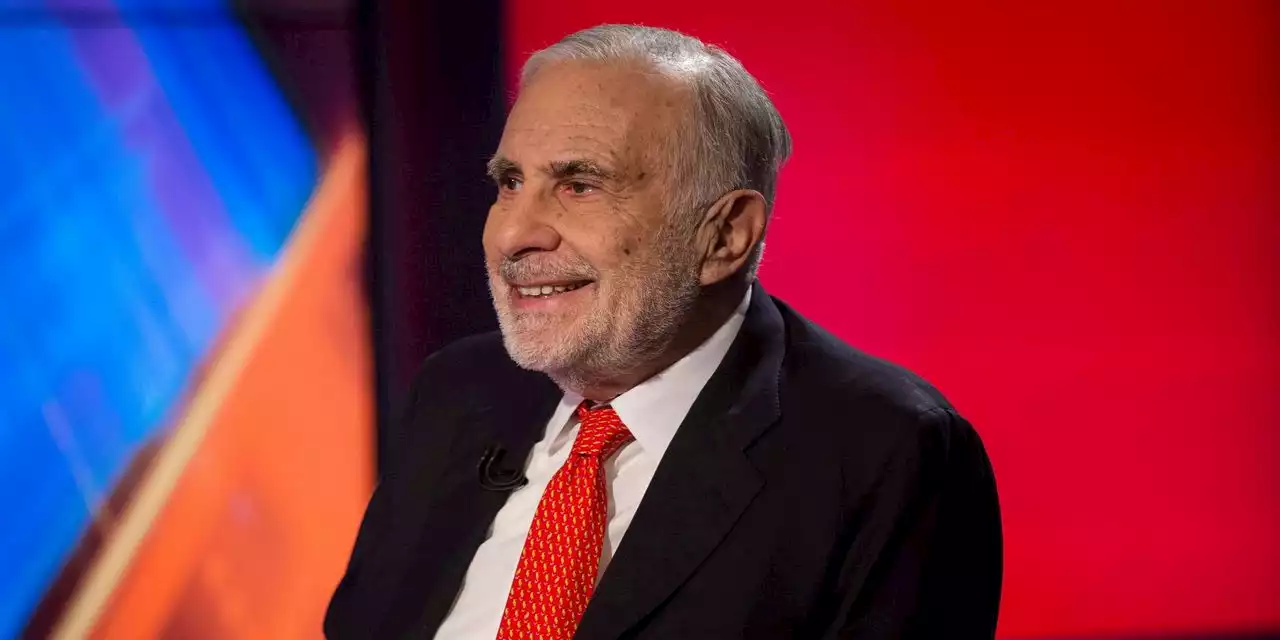

Icahn Enterprises LP shares fell another 20% on Wednesday, extending their prior-day losses in the continued fallout from a short seller’s report that was critical of the investment arm of activist investor Carl Icahn.

The stock closed down 20% on Tuesday to notch its biggest one-day decline on record after short seller Hindenburg Research accused the company of inflating its value. The market-cap loss was about $4 billion. If today’s slide holds, it will cost another $2.6 billion in market cap. “We stand by our public disclosures and we believe that [Icahn Enterprises’] performance will speak for itself over the long term as it always has,” Icahn said in the statement.

Icahn Enterprises offers exposure to Icahn’s personal portfolio of public and private companies, including petroleum refineries, car-parts makers, food-packaging companies and real estate.

Argentina Últimas Noticias, Argentina Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

Icahn Enterprises stock skids lower as short seller Hindenburg puts Carl Icahn's company in crosshairsHindenburg Research said it is betting against Icahn Enterprises and contends the company is overvalued compared with peers.

Icahn Enterprises stock skids lower as short seller Hindenburg puts Carl Icahn's company in crosshairsHindenburg Research said it is betting against Icahn Enterprises and contends the company is overvalued compared with peers.

Leer más »

Hindenburg Research blasts Carl Icahn’s hedge fund as ‘Ponzi-like’ in latest short-seller campaignHindenburg revealed that it has taken a short position on units of Icahn Enterprises.

Hindenburg Research blasts Carl Icahn’s hedge fund as ‘Ponzi-like’ in latest short-seller campaignHindenburg revealed that it has taken a short position on units of Icahn Enterprises.

Leer más »

Illumina: Icahn’s nominees ‘unqualified’Illumina Inc. said Monday that activist investor Carl Icahn’s board nominees are “unqualified,” urging shareholders to reject all three of Icahn’s nominees...

Illumina: Icahn’s nominees ‘unqualified’Illumina Inc. said Monday that activist investor Carl Icahn’s board nominees are “unqualified,” urging shareholders to reject all three of Icahn’s nominees...

Leer más »

Battle of the Activists: Hindenburg Shorts IcahnShares in Icahn Enterprises lost roughly a fifth of their value after short seller Hindenburg Research published a report saying the company was overvalued and holding assets at inflated prices.

Battle of the Activists: Hindenburg Shorts IcahnShares in Icahn Enterprises lost roughly a fifth of their value after short seller Hindenburg Research published a report saying the company was overvalued and holding assets at inflated prices.

Leer más »

Billionaire Carl Icahn’s Empire Propped Up By ‘Ponzi-Like’ Scheme, Short-Seller Hindenburg ClaimsA Hindenburg Research report claims billionaire investor Carl Icahn's storied holding company has artificially propped up its stock price with a “ponzi-like economic structure.'

Billionaire Carl Icahn’s Empire Propped Up By ‘Ponzi-Like’ Scheme, Short-Seller Hindenburg ClaimsA Hindenburg Research report claims billionaire investor Carl Icahn's storied holding company has artificially propped up its stock price with a “ponzi-like economic structure.'

Leer más »

Hindenburg Research goes after Carl Icahn in latest campaign for market-moving short sellerThe Nathan Anderson-led firm took a short position against Icahn Enterprises, alleging 'inflated' asset valuations, among other reasons.

Hindenburg Research goes after Carl Icahn in latest campaign for market-moving short sellerThe Nathan Anderson-led firm took a short position against Icahn Enterprises, alleging 'inflated' asset valuations, among other reasons.

Leer más »