'The 'Tax Cuts for Working Families Act'...inexplicably penalizes marriage among the working class and subsidizes cohabitation — the exact opposite of what family-friendly policies should do in a day and age when marriage is in trouble.' -Bradford Wilcox

A record-high 25% of 40-year-olds in the United States were never married in 2021, according to sobering new statistics from the Pew Research Center. That statistic compares to just 6% of never-married 40-year-olds in 1980, underscoring marriage’s falling fortunes in recent decades.Digging further into the Pew data reveals that this retreat from marriage and family life has hit vulnerable populations the hardest: minorities, the working class, and poor Americans.

The “Tax Cuts for Working Families Act,” which recently passed the House Ways and Means Committee headed by Chairman Jason Smith , inexplicably penalizes marriage among the working class and subsidizes cohabitation — the exact opposite of what family-friendly policies should do in a day and age when marriage is in trouble.

Rather than explore ways to shore up the credit to support families in their key child-rearing years, the Tax Cuts for Working Families Act would simply increase the standard deduction for all households — $2,000 for singles, $3,000 for heads of household, and $4,000 for married couples. Most of the law’s benefits would flow to affluent households rather than to the middle- and working-class families who need the most help.

As Patrick T. Brown of the Ethics and Public Policy Center noted, Republicans who trumpet their commitment to the family could at least make sure their family bill doesn’t penalize our nation’s most fundamental institution: marriage.

Argentina Últimas Noticias, Argentina Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

Binance Tax Watch: Crypto Tax Developments in April and May 2023 | Binance BlogIt can be difficult to keep up with all the tax changes in crypto. Make it easier on yourself. Find all the most important updates from around the world, between April to May, in the blog below.

Binance Tax Watch: Crypto Tax Developments in April and May 2023 | Binance BlogIt can be difficult to keep up with all the tax changes in crypto. Make it easier on yourself. Find all the most important updates from around the world, between April to May, in the blog below.

Leer más »

Illinois grocery tax break ends Saturday as gas tax goes upIllinois consumers on July 1 face a one-two punch as a one-year suspension of the state's grocery tax ends, and the gas tax goes up for the second time this year.

Illinois grocery tax break ends Saturday as gas tax goes upIllinois consumers on July 1 face a one-two punch as a one-year suspension of the state's grocery tax ends, and the gas tax goes up for the second time this year.

Leer más »

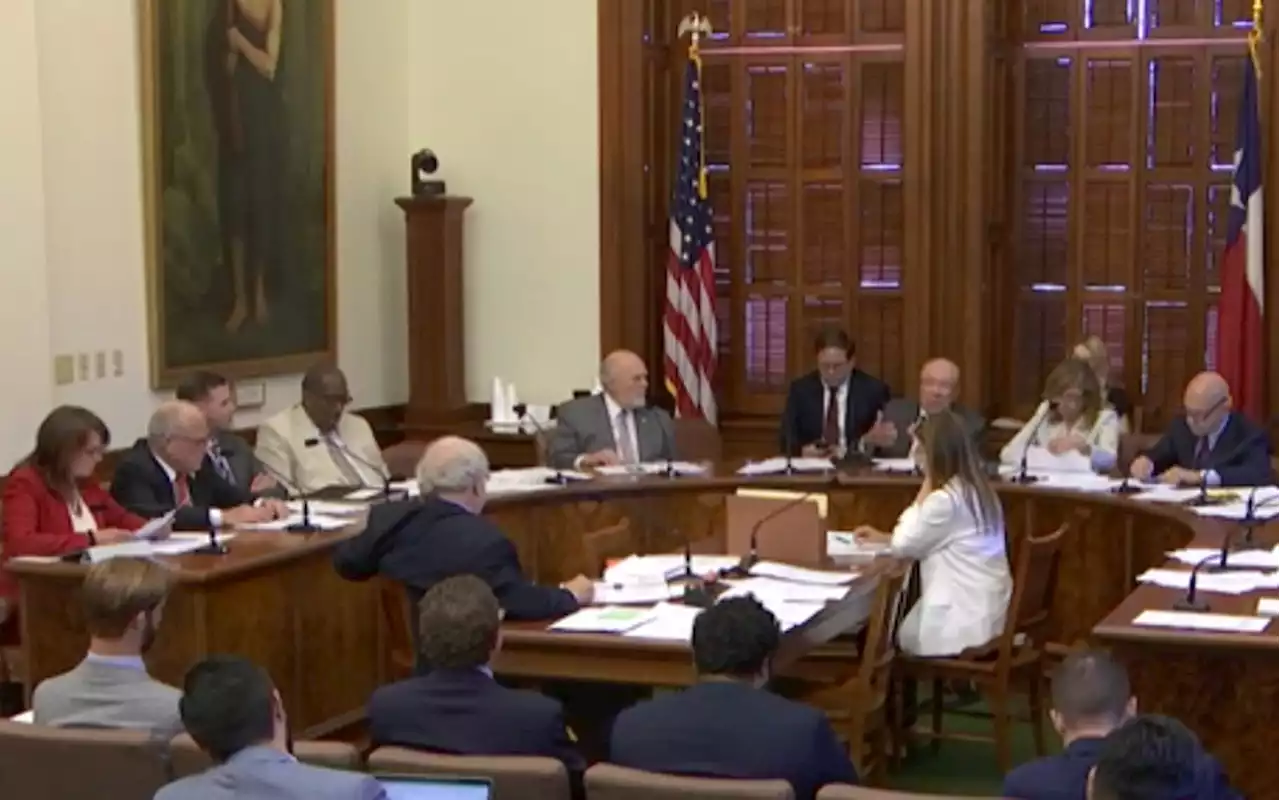

Special Session 2: Texas House and Senate Remain at Odds Over Property Tax ReliefThe first official day of the second special session called by Governor Greg Abbott to tackle property tax relief ended with both legislative chambers continuing to back separate proposals – signaling negotiations are still at an impasse. House Bill 1 by Representative Morgan Meyer (R-University Park), which passed unanimously in...

Special Session 2: Texas House and Senate Remain at Odds Over Property Tax ReliefThe first official day of the second special session called by Governor Greg Abbott to tackle property tax relief ended with both legislative chambers continuing to back separate proposals – signaling negotiations are still at an impasse. House Bill 1 by Representative Morgan Meyer (R-University Park), which passed unanimously in...

Leer más »

House GOP committee chairs expand Hunter Biden tax probeUnder the agreement, Hunter Biden will plead guilty to a pair of misdemeanor tax charges and the gun charges will be dropped if he completes two years of probation.

House GOP committee chairs expand Hunter Biden tax probeUnder the agreement, Hunter Biden will plead guilty to a pair of misdemeanor tax charges and the gun charges will be dropped if he completes two years of probation.

Leer más »

Supreme Court will hear case with major implications for liberal 'wealth tax' plansThe Supreme Court has agreed to hear a tax case that could put the fate of the Biden administration's 'wealth tax' and other future tax proposals in jeopardy. It could pump the brakes on POTUS's tax proposal aimed at taxing the U.S.'s ultra-wealthy.

Supreme Court will hear case with major implications for liberal 'wealth tax' plansThe Supreme Court has agreed to hear a tax case that could put the fate of the Biden administration's 'wealth tax' and other future tax proposals in jeopardy. It could pump the brakes on POTUS's tax proposal aimed at taxing the U.S.'s ultra-wealthy.

Leer más »

Republican Sen. Tommy Tuberville faces growing bipartisan ire at defense blockadeSen. Chuck Grassley, a Republican from Iowa, warned that he believes in senators being able to use their leverage over nominees, but even he is worried that if agency-wide holds get used too often,…

Republican Sen. Tommy Tuberville faces growing bipartisan ire at defense blockadeSen. Chuck Grassley, a Republican from Iowa, warned that he believes in senators being able to use their leverage over nominees, but even he is worried that if agency-wide holds get used too often,…

Leer más »