Gold prices eased in a narrow range on Tuesday as traders assessed comments from U.S. central bank officials on interest rates staying high.

Fed members continue to push back on rate cuts this year and that is pushing gold slightly lower, said Matt Simpson, a senior market analyst at City Index, adding gold's failure to hold above the previous record high has shaken confidence.hinted that its marathon hiking cycle may be ending.on Monday signaled they see interest rates staying high and, if anything, going higher, given inflation that may be slow to improve and an economy showing only tentative signs of weakness.

While gold is considered a hedge against inflation, rising interest rates dull the non-yielding bullion's appeal. "Hopes remain of a resolution whilst talks continue, but at the same time the risk of a U.S. default lingers as Democrats and Republicans run down the clock, and that has gold in a holding pattern," Simpson added.

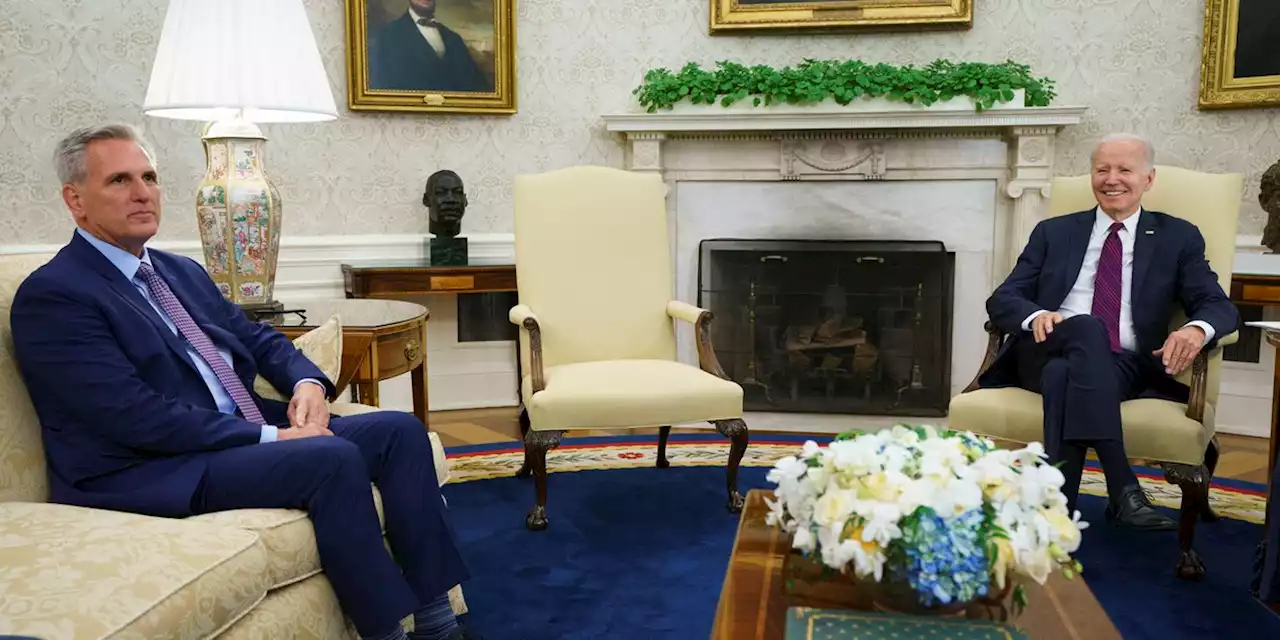

Market participants were closely following developments in the debt ceiling debate, with President Joe Biden and Republican House of Representatives Speaker Kevin McCarthyAlso on investors' radar were U.S. retail sales and industrial production data for April.

Argentina Últimas Noticias, Argentina Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

Biden expects to meet lawmakers Tuesday for debt talks, says he is optimisticU.S. President Joe Biden said on Sunday he expects to meet with congressional leaders on Tuesday for talks on a plan to raise the nation's debt limit and avoid a catastrophic default.

Biden expects to meet lawmakers Tuesday for debt talks, says he is optimisticU.S. President Joe Biden said on Sunday he expects to meet with congressional leaders on Tuesday for talks on a plan to raise the nation's debt limit and avoid a catastrophic default.

Leer más »

Debt-ceiling talks between Biden, congressional leaders likely to resume TuesdayThe second round of debt-ceiling talks between the White House and congressional leaders is tentatively set for Tuesday, President Joe Biden said Sunday.

Debt-ceiling talks between Biden, congressional leaders likely to resume TuesdayThe second round of debt-ceiling talks between the White House and congressional leaders is tentatively set for Tuesday, President Joe Biden said Sunday.

Leer más »

Biden, congressional leaders likely to meet Tuesday for talks on raising the debt limitPresident Joe Biden says he and congressional leaders will likely resume talks on Tuesday at the White House over the debt limit as the nation continues to edge closer to its legal borrowing authority with no agreement in sight.

Biden, congressional leaders likely to meet Tuesday for talks on raising the debt limitPresident Joe Biden says he and congressional leaders will likely resume talks on Tuesday at the White House over the debt limit as the nation continues to edge closer to its legal borrowing authority with no agreement in sight.

Leer más »

Biden likely to resume debt limit talks on TuesdayThe nation continues to edge closer to its legal borrowing authority with no agreement in sight. The Treasury Department has said the government could exhaust the ability to pay its bills as early as June 1.

Biden likely to resume debt limit talks on TuesdayThe nation continues to edge closer to its legal borrowing authority with no agreement in sight. The Treasury Department has said the government could exhaust the ability to pay its bills as early as June 1.

Leer más »

Biden, congressional leaders likely to meet Tuesday for talks on raising the debt limitBiden did not detail much progress in the talks, but said he remained hopeful that an agreement could be reached with Republicans to avoid what would be an unprecedented debt default.

Biden, congressional leaders likely to meet Tuesday for talks on raising the debt limitBiden did not detail much progress in the talks, but said he remained hopeful that an agreement could be reached with Republicans to avoid what would be an unprecedented debt default.

Leer más »

Biden, congressional leaders likely to meet Tuesday for talks on raising the debt limitPresident Joe Biden says he and congressional leaders will likely resume talks on Tuesday at the White House over the debt limit as the nation continues to edge closer to its legal borrowing authority with no agreement in sight.

Biden, congressional leaders likely to meet Tuesday for talks on raising the debt limitPresident Joe Biden says he and congressional leaders will likely resume talks on Tuesday at the White House over the debt limit as the nation continues to edge closer to its legal borrowing authority with no agreement in sight.

Leer más »