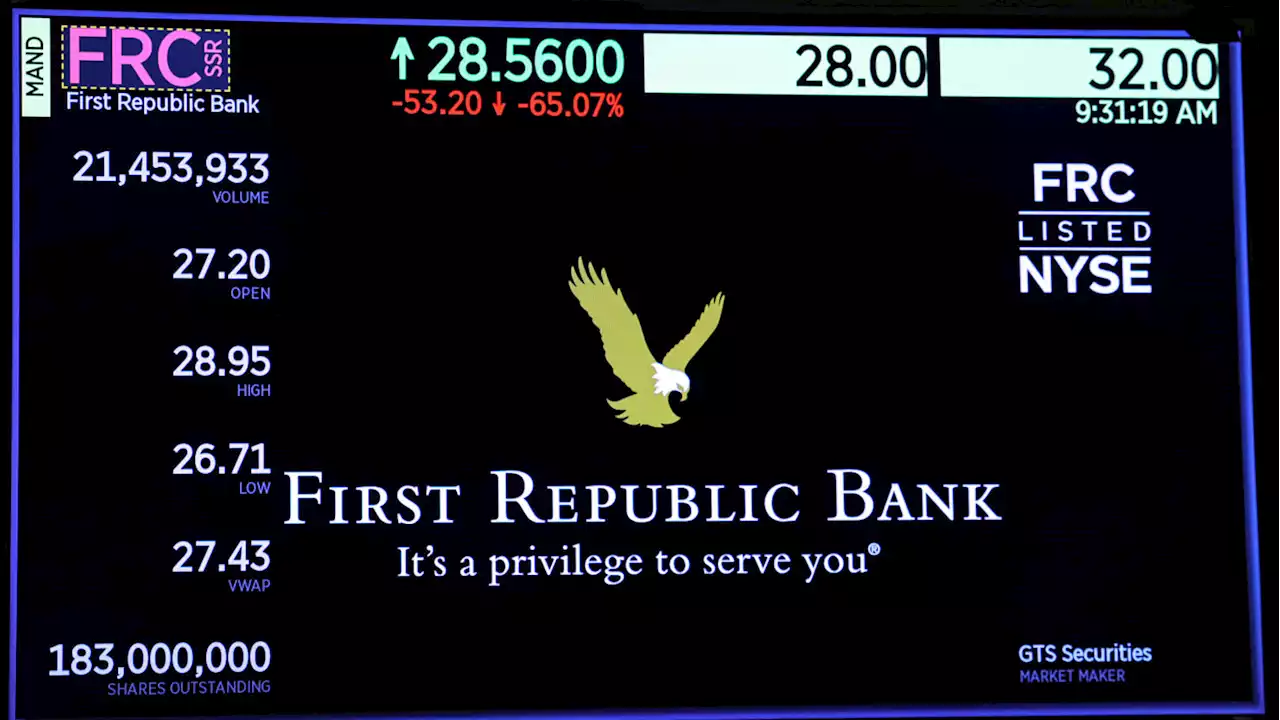

The troubled bank has been in turmoil since the collapse of Silicon Valley Bank.

Mid-size bank First Republic is exploring a potential sale after its shares plummeted amid instability in the banking sector, Bloomberg firstWednesday.

The bank, based in San Francisco, hasn’t been able to gain footing following the collapse of Silicon Valley Bank, with its shares falling 70 percent. The bank secured $70 billion in liquidity from the Federal Reserve and JPMorgan Chase on Sunday on top of emergency funding. First Republic is exploring other options aside from a sale, including an infusion of cash, but a source told

Argentina Últimas Noticias, Argentina Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

![]() Easy Loans, Great Service: Why Silicon Valley Loved Silicon Valley BankSilicon Valley Bank used financial sweeteners to attract clients, powering growth for decades—leaving the sector vulnerable when the bank collapsed

Easy Loans, Great Service: Why Silicon Valley Loved Silicon Valley BankSilicon Valley Bank used financial sweeteners to attract clients, powering growth for decades—leaving the sector vulnerable when the bank collapsed

Leer más »

![]() Silicon Valley Bank collapse was driven by 'the first Twitter fueled bank run'The massive amount of customer withdrawals that led to the collapse of Silicon Valley Bank had all the hallmarks of an old-fashioned bank run, but with a new twist -- much of it unfolded online.

Silicon Valley Bank collapse was driven by 'the first Twitter fueled bank run'The massive amount of customer withdrawals that led to the collapse of Silicon Valley Bank had all the hallmarks of an old-fashioned bank run, but with a new twist -- much of it unfolded online.

Leer más »

![]() KPMG stands by audits of Silicon Valley Bank and Signature Bank - FTKPMG's U.S. boss, Paul Knopp, said the accounting firm stood behind its audits of Silicon Valley Bank and Signature Bank , the Financial Times reported on Tuesday.

KPMG stands by audits of Silicon Valley Bank and Signature Bank - FTKPMG's U.S. boss, Paul Knopp, said the accounting firm stood behind its audits of Silicon Valley Bank and Signature Bank , the Financial Times reported on Tuesday.

Leer más »

![]() Silicon Valley Bank: How a digital bank run accelerated the collapseThe second-biggest bank failure in U.S. history took less than 48 hours.

Silicon Valley Bank: How a digital bank run accelerated the collapseThe second-biggest bank failure in U.S. history took less than 48 hours.

Leer más »

![]() Silicon Valley Bank collapse throws up uncertainty for a European Central Bank hoping to hike ratesEuropean markets closed sharply lower Monday amid the fallout from the SVB crisis.

Silicon Valley Bank collapse throws up uncertainty for a European Central Bank hoping to hike ratesEuropean markets closed sharply lower Monday amid the fallout from the SVB crisis.

Leer más »

![]() Why Did Silicon Valley Bank and Signature Bank Fail So Fast?A professor of economics explains why the country's banking crisis isn’t over yet.

Why Did Silicon Valley Bank and Signature Bank Fail So Fast?A professor of economics explains why the country's banking crisis isn’t over yet.

Leer más »