Fed induced volatility of USD exchange rates to continue even after the summer – Commerzbank Fed DollarIndex Currencies Banks InterestRate

“Because Powell had sounded uber-hawkish in the past, he was only able to surprise on the dovish side or come across as neutral at best. But not always, not yesterday. It made little difference that the Fed Chair repeated over and over again that there would be further rate hikes and that there would probably be no rate cuts this year.”

“Slowly a double discrepancy is emerging between the market view and the Fed: disagreement about the final peak in interest rates and disagreement on whether there will be rate cuts this year. The first of these two discrepancies will be decided in the spring, but I believe the FX market is more interested in the second aspect. That means that theInformation on these pages contains forward-looking statements that involve risks and uncertainties.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Argentina Últimas Noticias, Argentina Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

Fed: Hard to see a USD-positive result from policy decisions – CommerzbankUlrich Leuchtmann, Head of FX and Commodity Research, lacks the imagination to see the US Dollar benefiting from the US Federal Reserve's (Fed) policy

Fed: Hard to see a USD-positive result from policy decisions – CommerzbankUlrich Leuchtmann, Head of FX and Commodity Research, lacks the imagination to see the US Dollar benefiting from the US Federal Reserve's (Fed) policy

Leer más »

GBP/USD finds cushion around 1.2300 as USD Index retreats, Fed-BoE policy hogs limelightThe GBP/USD pair has gauged an intermediate cushion after dropping to near the crucial support around 1.2300 in the Asian session. The Cable has gaine

GBP/USD finds cushion around 1.2300 as USD Index retreats, Fed-BoE policy hogs limelightThe GBP/USD pair has gauged an intermediate cushion after dropping to near the crucial support around 1.2300 in the Asian session. The Cable has gaine

Leer más »

Fed Preview: Three scenarios and its implications for EUR/USD and USD/JPY – TDSEconomists at TD Securities discuss the Federal Reserve interest rate decision and its implications for EUR/USD and USD/JPY. Hawkish (25%) “The FOMC d

Fed Preview: Three scenarios and its implications for EUR/USD and USD/JPY – TDSEconomists at TD Securities discuss the Federal Reserve interest rate decision and its implications for EUR/USD and USD/JPY. Hawkish (25%) “The FOMC d

Leer más »

FOMC: Hawkish Fed Could Trigger EUR/USD GBP/USD PullbackFOMC: Hawkish Fed Could Trigger EUR/USD GBP/USD Pullback.The Wednesday Market Oulook with Warren Venketas gives a report on the latest changes in the financi...

FOMC: Hawkish Fed Could Trigger EUR/USD GBP/USD PullbackFOMC: Hawkish Fed Could Trigger EUR/USD GBP/USD Pullback.The Wednesday Market Oulook with Warren Venketas gives a report on the latest changes in the financi...

Leer más »

EUR/USD: ECB’s current approach to support Euro – CommerzbankThe ECB prepared the market well for today’s rate meeting. Esther Reichelt, FX Analyst at Commerzbank, notes that the Euro is well positioned to stren

EUR/USD: ECB’s current approach to support Euro – CommerzbankThe ECB prepared the market well for today’s rate meeting. Esther Reichelt, FX Analyst at Commerzbank, notes that the Euro is well positioned to stren

Leer más »

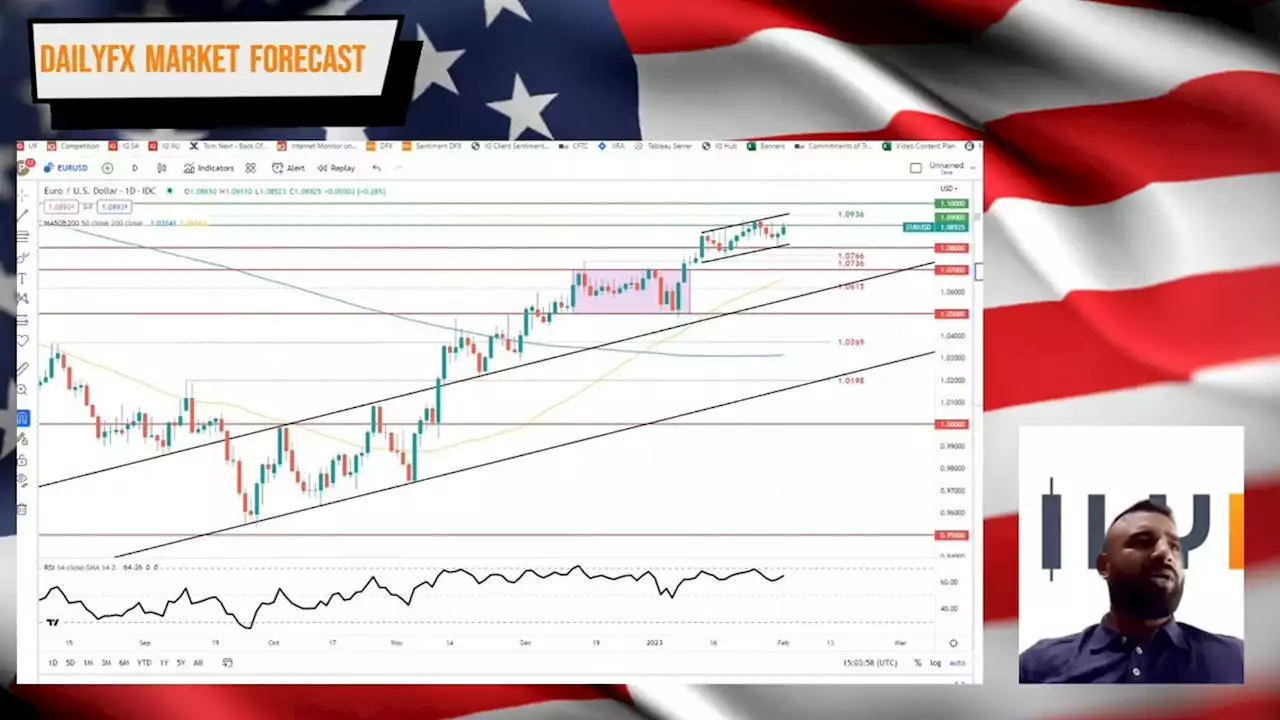

Euro Forecast: USD Controlling EUR/USD Price Action Dismissive of Positive EZ DataThe euro received several key economic data prints from various parts of the eurozone today but did not necessarily reflect the data via the EUR/USD currency pair. Get your market update from WVenketas here:

Euro Forecast: USD Controlling EUR/USD Price Action Dismissive of Positive EZ DataThe euro received several key economic data prints from various parts of the eurozone today but did not necessarily reflect the data via the EUR/USD currency pair. Get your market update from WVenketas here:

Leer más »