European markets are set to climb, tracking global sentiment after the U.S. Federal Reserve doused speculation about more aggressive monetary tightening.

The war in Ukraine also remains on investors' radar. Russian forces have reportedly renewed their assault on the Azovstal steelworks complex, a last stronghold for Ukrainian fighters in the southern port city of Mariupol.in its sixth round of sanctions against Moscow since the unprovoked invasion of Ukraine.

Corporate earnings continue to guide individual share price action in Europe. Shell, BMW, Leonardo, UniCredit, Intesa Sanpaolo, Banco BPM, Societe Generale, Credit Agricole, AXA, Stellantis and Air France KLM were among those reporting before the bell on Thursday.for exclusive insights and analysis, and live business day programming from around the world.

Argentina Últimas Noticias, Argentina Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

Dollar recoils as Fed douses hawkish betsThe dollar was nursing its sharpest fall in more than a month on Thursday after the U.S. Federal Reserve raised its benchmark interest rate by 50 basis points but poured cold water on the idea that even larger rises could lie ahead.

Dollar recoils as Fed douses hawkish betsThe dollar was nursing its sharpest fall in more than a month on Thursday after the U.S. Federal Reserve raised its benchmark interest rate by 50 basis points but poured cold water on the idea that even larger rises could lie ahead.

Leer más »

European Markets Cautious as Focus Turns to FedEuropean markets were muted on Wednesday as global investors await a crucial monetary policy decision from the U.S. Federal Reserve.

European Markets Cautious as Focus Turns to FedEuropean markets were muted on Wednesday as global investors await a crucial monetary policy decision from the U.S. Federal Reserve.

Leer más »

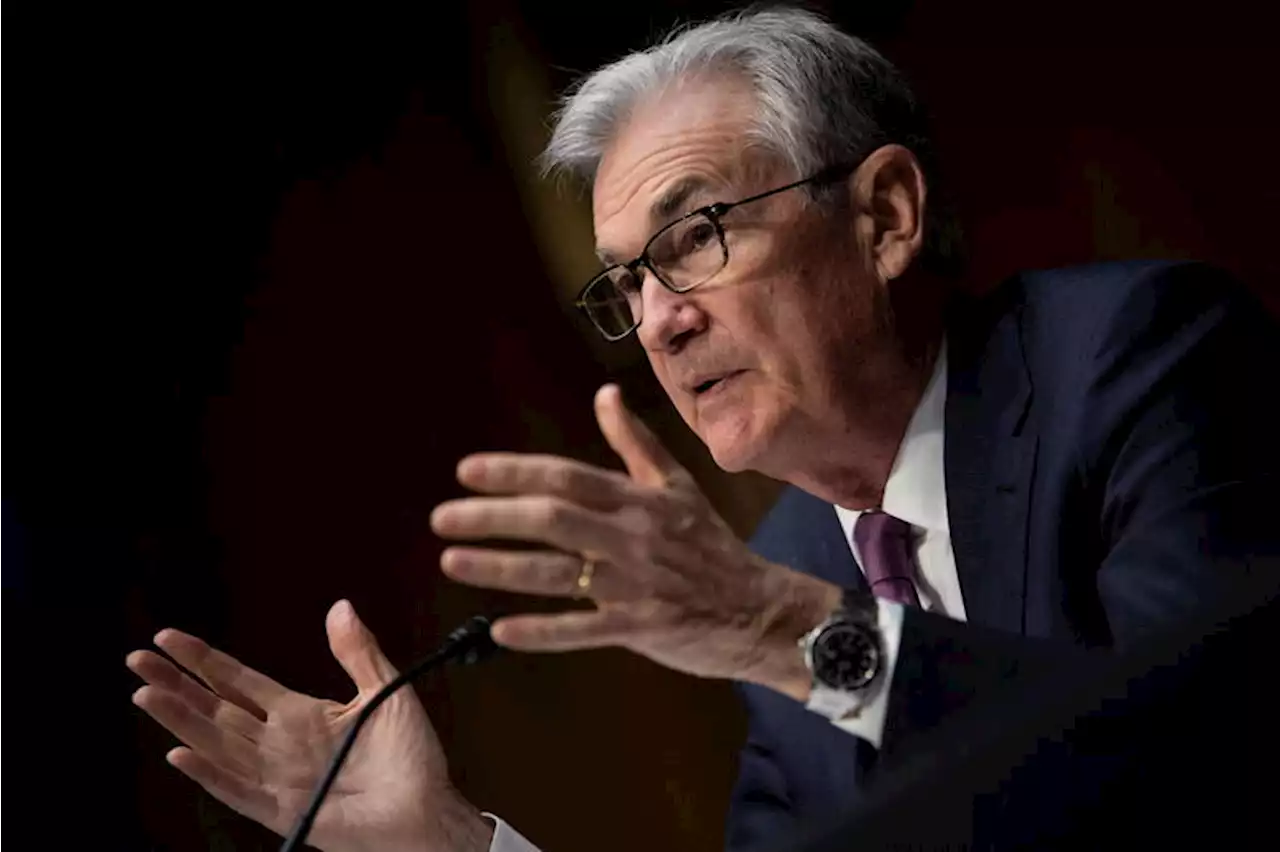

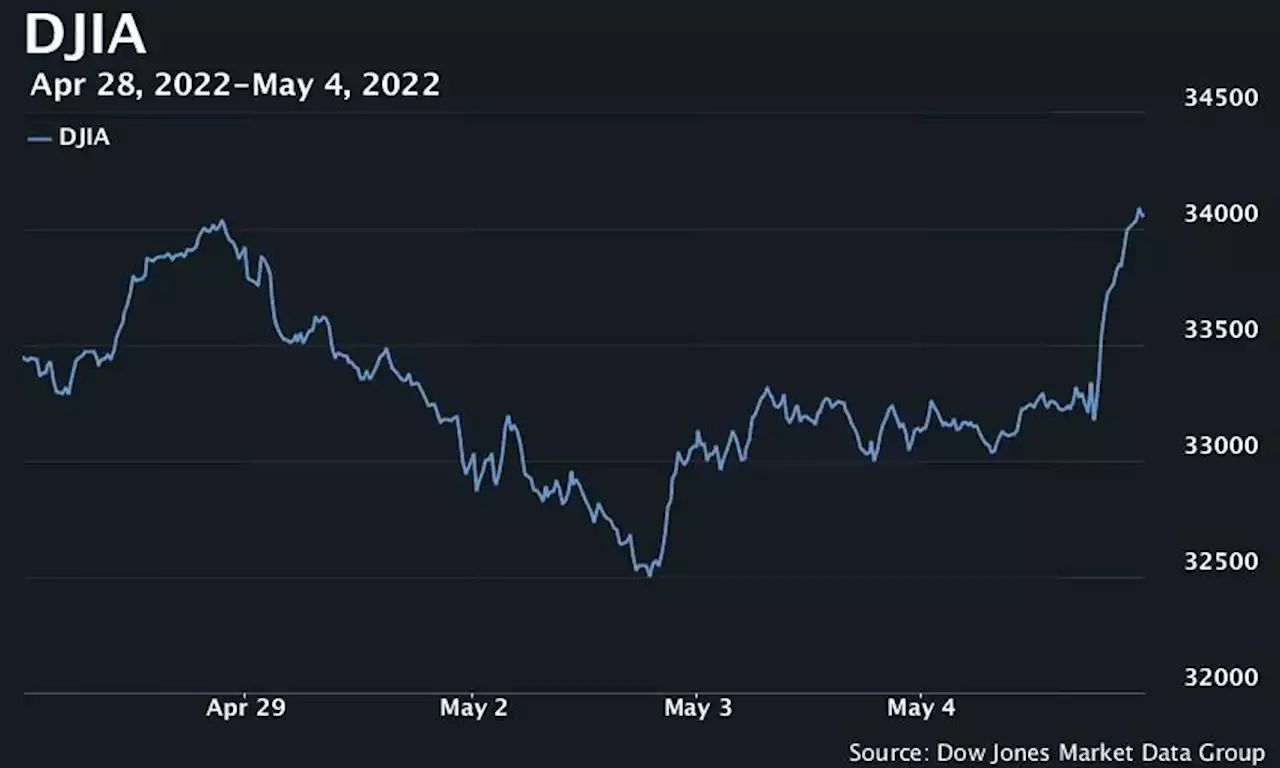

The Dow rallies to its best day since 2020 after the Fed rules out larger rate hikesMarkets jumped after Fed Chair Jerome Powell said the central bank was not contemplating bigger rate hikes than the half-a-percentage-point increase it delivered on Wednesday.

The Dow rallies to its best day since 2020 after the Fed rules out larger rate hikesMarkets jumped after Fed Chair Jerome Powell said the central bank was not contemplating bigger rate hikes than the half-a-percentage-point increase it delivered on Wednesday.

Leer más »

Fed jumps into field of financial land minesThe American central bank has little choice but to hike interest rates and cut its balance sheet to fight inflation. But Chair Jay Powell’s moves make the $24 trln U.S. Treasury market more vulnerable to shocks. Bigger future increases could even tip the U.S. into recession.

Fed jumps into field of financial land minesThe American central bank has little choice but to hike interest rates and cut its balance sheet to fight inflation. But Chair Jay Powell’s moves make the $24 trln U.S. Treasury market more vulnerable to shocks. Bigger future increases could even tip the U.S. into recession.

Leer más »

Dow ends over 900 points higher as Fed's Powell sparks relief rallyU.S. stocks closed sharply higher Wednesday, jumping as Federal Reserve Chair Jerome Powell delivered remarks following the conclusion of the Fed's two-day policy meeting. The DJIA ended around 932 points higher, or 2.8%.

Dow ends over 900 points higher as Fed's Powell sparks relief rallyU.S. stocks closed sharply higher Wednesday, jumping as Federal Reserve Chair Jerome Powell delivered remarks following the conclusion of the Fed's two-day policy meeting. The DJIA ended around 932 points higher, or 2.8%.

Leer más »

Fed expected to aggressively raise interest rates to tame inflationThe Fed is expected to raise interest rates this week with the biggest jump in more than 20 years as the central bank tries to get control of historic inflation.

Fed expected to aggressively raise interest rates to tame inflationThe Fed is expected to raise interest rates this week with the biggest jump in more than 20 years as the central bank tries to get control of historic inflation.

Leer más »