Stocks sank in morning trading on Wall Street, putting the benchmark S&P 500 on track for what the market considers a correction—a drop of 10% or more from its most recent high.

Stocks extended their three-week decline on Wall Street and put the benchmark S&P 500 on track to a so-called correction — a drop of 10% or more from its most recent high. The price of oil and bitcoin fell, and so did the yield on 10-year Treasury notes, a sign of investor concern about the economy.

Technology stocks again led the broader decline in the market as investors shift money away from pricier stocks in anticipation of rising interest rates. Higher rates make shares in high-flying tech companies and other expensive growth stocks relatively less attractive. The market is waiting to hear from Federal Reserve policymakers after their latest meeting ends Wednesday. Some economists have expressed concern that the Fed is already moving too late to combat high inflation.

The Fed’s benchmark short-term interest rate is currently in a range of 0% to 0.25%. Investors now see a nearly 65% chance that the Fed will raise the rate four times by the end of the year, up from a 35% chance a month ago, according to CME Group’s Fed Watch tool. Europe’s STOXX 600 index closed down 3.6% on concerns about Fed tightening and worries about the situation around Ukraine. The Russian ruble has also fallen after U.S. President Joe Biden indicated that in the event of a Russian invasion the U.S. could block Russian banks from access to dollars or impose other sanctions.

Inflation is putting pressure on businesses and consumers as demand for goods continues to outpace supplies. Companies have been warning that supply chain problems and rising raw materials costs could crimp their finances. Retailers, food producers and others have been raising prices on goods to try and offset the impact.

Argentina Últimas Noticias, Argentina Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

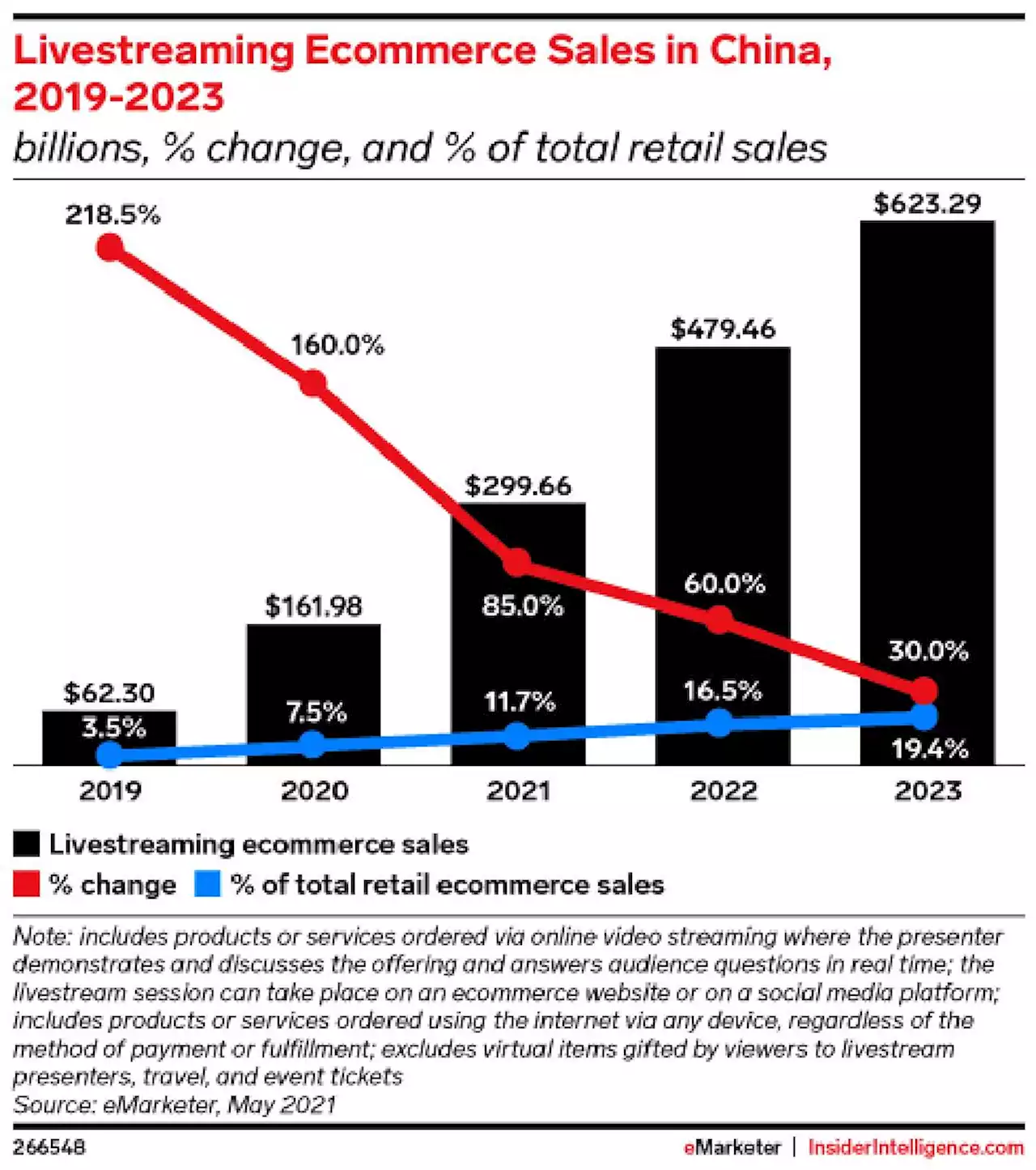

Livestream Shopping: A $500 Billion Market In 2022 As Amazon, Google, Facebook, TikTok Jump In?Amazon is investing big in Amazon Live. Google has live shopping on YouTube. Pinterest, seemingly a great fit for this kind of venture, announced a livestream shopping project late last year. Twitter is working on livestream shopping. Facebook is investing, particularly on Instagram.

Livestream Shopping: A $500 Billion Market In 2022 As Amazon, Google, Facebook, TikTok Jump In?Amazon is investing big in Amazon Live. Google has live shopping on YouTube. Pinterest, seemingly a great fit for this kind of venture, announced a livestream shopping project late last year. Twitter is working on livestream shopping. Facebook is investing, particularly on Instagram.

Leer más »

How Bad Are Things in China’s Property Market?Government curbs on borrowing in China’s property sector have triggered uncertainty for many market participants. Here’s where the market stands as 2022 gets under way.

How Bad Are Things in China’s Property Market?Government curbs on borrowing in China’s property sector have triggered uncertainty for many market participants. Here’s where the market stands as 2022 gets under way.

Leer más »

Bearish chart pattern hints at $70 Solana (SOL) price before a possible oversold bounceThe head and shoulders pattern on Solana’s daily chart sets a $70 target for $SOL, but the current market-wide sell-off could see prices slip even further.

Bearish chart pattern hints at $70 Solana (SOL) price before a possible oversold bounceThe head and shoulders pattern on Solana’s daily chart sets a $70 target for $SOL, but the current market-wide sell-off could see prices slip even further.

Leer más »

Nations to adopt Bitcoin, crypto users to reach 1B by 2023: ReportCountries could follow El Salvador's lead while relaxed regulation driven by retail adoption could spur the market in 2022.

Nations to adopt Bitcoin, crypto users to reach 1B by 2023: ReportCountries could follow El Salvador's lead while relaxed regulation driven by retail adoption could spur the market in 2022.

Leer más »

11 Customer Feedback Software that Would Revolutionize 2022 | HackerNoonSeveral customer feedback software is taking the market by storm. Experience the functions of some of the leading survey tools dominating 2022.

11 Customer Feedback Software that Would Revolutionize 2022 | HackerNoonSeveral customer feedback software is taking the market by storm. Experience the functions of some of the leading survey tools dominating 2022.

Leer más »

Thinking of buying a home in 2022? Here's what to expectIf you're one of many would-be homebuyers who got shut out of the real estate market last year, you might be hoping for better luck in 2022. This is what to expect.

Thinking of buying a home in 2022? Here's what to expectIf you're one of many would-be homebuyers who got shut out of the real estate market last year, you might be hoping for better luck in 2022. This is what to expect.

Leer más »