Avoid leaving money on the table for the IRS answering these questions.

If you’re under age 65 and qualify to make health savings account contributions, consider maximizing HSA contributions before IRA and 401 contributions. HSAs can be the best retirement saving tool. It often is good to maximize HSA contributions before contributing to an IRA or 401 because of the triple tax-free benefits of HSAs, though you first might want to contribute enough to a 401 to maximize employer matching contributions.

When you’re still working and can participate in a 401 plan, review how much of your paycheck to defer to the 401 next year. Tax-deferred 401 contributions are capped at $22,500 in 2023 plus another $7,500 catch-up contribution for those 50 and older. Remember you can make additional after-tax deferrals to a 401 until total contributions to your account are $66,000 in 2023, plus the $7,500 catch-up contribution if you’re 50 or older.

In the year an IRA owner passes away, the RMD has to be taken. If the owner didn’t take the RMD before passing away, a beneficiary must take the RMD and include it in his or her income.Under the life expectancy tables for RMDs, a higher percentage of the IRA must be distributed each year. When the owner has a substantial IRA and has other assets and sources of income, the RMD often exceeds what the owner needs to meet expenses.

The strategies include converting a traditional IRA to a Roth IRA, using distributions from the IRA to buy permanent life insurance, using IRA distributions to fund a charitable remainder trust, and more.Most retirees have to make estimated income tax payments four times during the year, because they don’t have paychecks from which taxes are withheld.

When taxes are withheld from a payment, they’re treated as being withheld evenly during the year even if one large amount was withheld near the end of the year. If you didn’t make adequate estimated tax payments earlier in the year, you can direct your IRA custodian to make a distribution to you near the end of the year and withhold enough for income taxes to meet your estimated tax requirements. You even can direct that the entire distribution be withheld as income taxes.

Argentina Últimas Noticias, Argentina Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

Gmail gets end-to-end encryption, but not everyone can test itGoogle is rolling out end-to-end encryption to Gmail, with a beta test available to Google Workspace users - what you need to know.

Gmail gets end-to-end encryption, but not everyone can test itGoogle is rolling out end-to-end encryption to Gmail, with a beta test available to Google Workspace users - what you need to know.

Leer más »

Pokemon Shares Major Update on Ash's Year-End SpecialWhile last week's Jump Festa featured some major news in the anime world for Shonen series old and [...]

Pokemon Shares Major Update on Ash's Year-End SpecialWhile last week's Jump Festa featured some major news in the anime world for Shonen series old and [...]

Leer más »

5 tasks for your year-end credit card checklistHere's an end-of-year checklist that can help ensure you're getting the most out of your credit card.

5 tasks for your year-end credit card checklistHere's an end-of-year checklist that can help ensure you're getting the most out of your credit card.

Leer más »

This 'wild card' strategy can help retirees with unpaid quarterly taxes before year-endIf you're retired and missed quarterly estimated tax payments for 2022, there's still a chance to avoid late penalties. Here's what to know.

This 'wild card' strategy can help retirees with unpaid quarterly taxes before year-endIf you're retired and missed quarterly estimated tax payments for 2022, there's still a chance to avoid late penalties. Here's what to know.

Leer más »

Year-End Funding Bill Includes Election Reforms Made to Avoid Another Jan. 6The year-end omnibus bill includes a set of election reforms crafted to make it harder for lawmakers to overturn presidential elections in response to January 6.

Year-End Funding Bill Includes Election Reforms Made to Avoid Another Jan. 6The year-end omnibus bill includes a set of election reforms crafted to make it harder for lawmakers to overturn presidential elections in response to January 6.

Leer más »

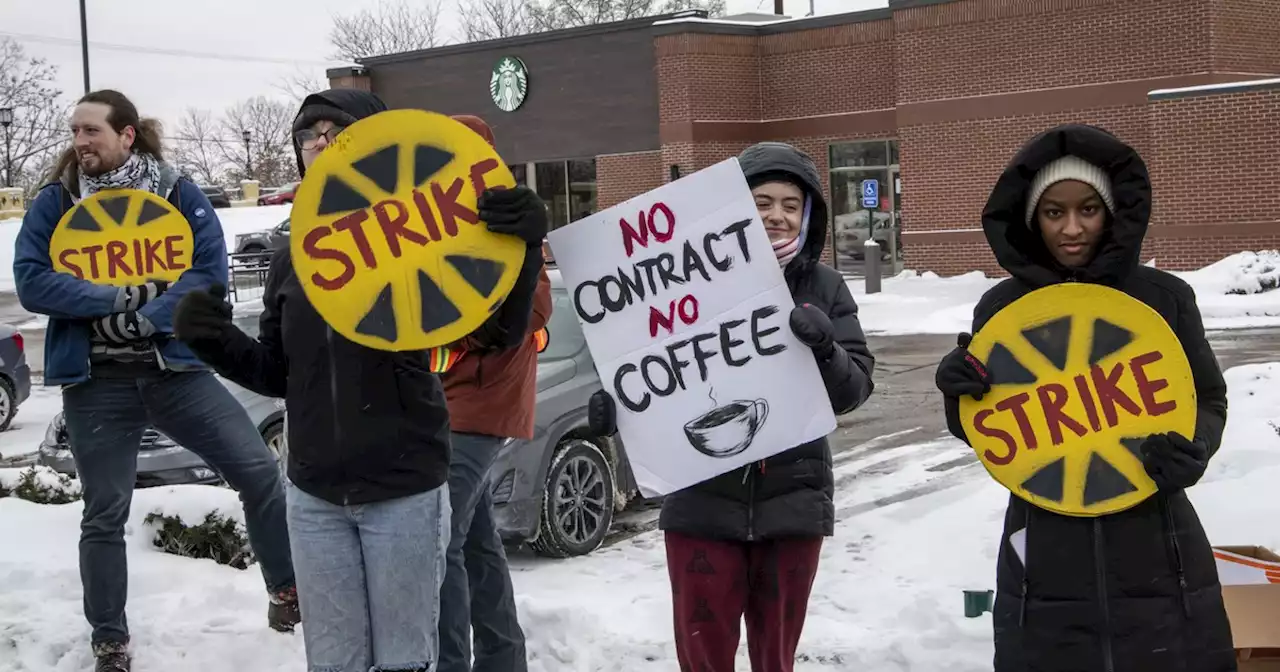

Unions Welcome $25 Million NLRB Funding Boost Included in Year-End Omnibus\u0022If passed by both chambers, the funding Armageddon we warned of has been avoided—for at least this year,\u0022 said the NLRB Union.

Unions Welcome $25 Million NLRB Funding Boost Included in Year-End Omnibus\u0022If passed by both chambers, the funding Armageddon we warned of has been avoided—for at least this year,\u0022 said the NLRB Union.

Leer más »