Credit bureaus want to score more Americans, by incorporating non-credit sources — timely rent payments, for instance — into their calculations.

Other credit-building companies, like TomoCredit and X1, make short-term loans underwritten against wealth or income rather than repayment history. Those loans then build a credit history, which becomes a credit score.Compared to someone with "very good" credit of between 740 and 799, someone with "fair" credit — between 630 and 689 — has to pay substantially more interest on their loans.

If a "credit invisible" person then ends up with a credit score that's very low, that can be worse than having no credit score at all,your car insurance rate — but in most states that allow insurers to use credit scores, the law specifically says that peopleSimilarly, having bad credit is worse than having no credit when you're applying for a job.

Having a subprime credit score also exposes people to some of the most predatory lenders in the industry."I have yet to see anyone go from credit invisible to a bad score," says Maitri Johnson, who oversees programs at TransUnion that incorporate rent payments into credit scores.All of these programs, so far, are opt-in. People who pay their rent on time are the people who try to improve their credit scores, or get a brand-new score that's reasonably healthy.

Argentina Últimas Noticias, Argentina Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

BoE's Pill: bond purchases won't cap long-term ratesThe Bank of England's aims to cure market dysfunction, not cap yields or offer cheaper credit to the government or financial institutions, BoE chief economist Huw Pill said.

BoE's Pill: bond purchases won't cap long-term ratesThe Bank of England's aims to cure market dysfunction, not cap yields or offer cheaper credit to the government or financial institutions, BoE chief economist Huw Pill said.

Leer más »

What is the economic impact of cryptocurrencies?As the world deals with inflation and growing concern over a potential recession, what role will crypto have during an economic downturn?

What is the economic impact of cryptocurrencies?As the world deals with inflation and growing concern over a potential recession, what role will crypto have during an economic downturn?

Leer más »

Zelle, Cash App, PayPal Scams: Reimbursement from payment app scams is possible.The Consumer Financial Protection Bureau says banks should reimburse victims for scam payment app transactions.

Zelle, Cash App, PayPal Scams: Reimbursement from payment app scams is possible.The Consumer Financial Protection Bureau says banks should reimburse victims for scam payment app transactions.

Leer más »

N.J. gets more good news from Wall Street in response to Murphy budgetNew Jersey has received multiple credit rating and outlook upgrades from Wall Street's four major rating agencies over the past year.

N.J. gets more good news from Wall Street in response to Murphy budgetNew Jersey has received multiple credit rating and outlook upgrades from Wall Street's four major rating agencies over the past year.

Leer más »

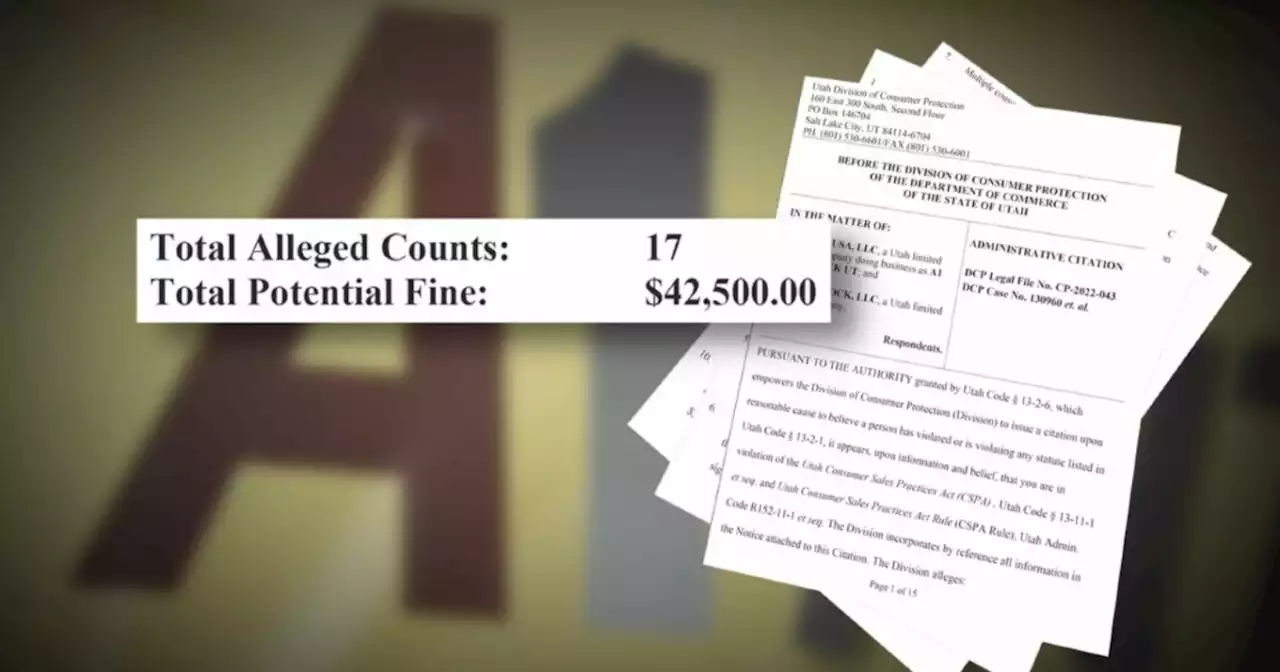

Utah consumer watchdog says company mislead DUI offenders on paymentsUtah company that installs devices measuring blood-alcohol content accused of misleading customers on what they had to pay and made unauthorized charges on their credit cards

Utah consumer watchdog says company mislead DUI offenders on paymentsUtah company that installs devices measuring blood-alcohol content accused of misleading customers on what they had to pay and made unauthorized charges on their credit cards

Leer más »

Circle acquires payment services firm ElementsCircle has acquired credit card processing solutions firm Elements, as it looks to quickly scale its payment offering.

Circle acquires payment services firm ElementsCircle has acquired credit card processing solutions firm Elements, as it looks to quickly scale its payment offering.

Leer más »